tax on venmo payments

All about taxes on Venmo. The new rule which affects tax year 2022 and beyond has lowered this amount to 600.

How Will The Irs Treat Your Venmo Payments To And From Your Business Boyer 2 Accountants Inc

Reporting income from Venmo.

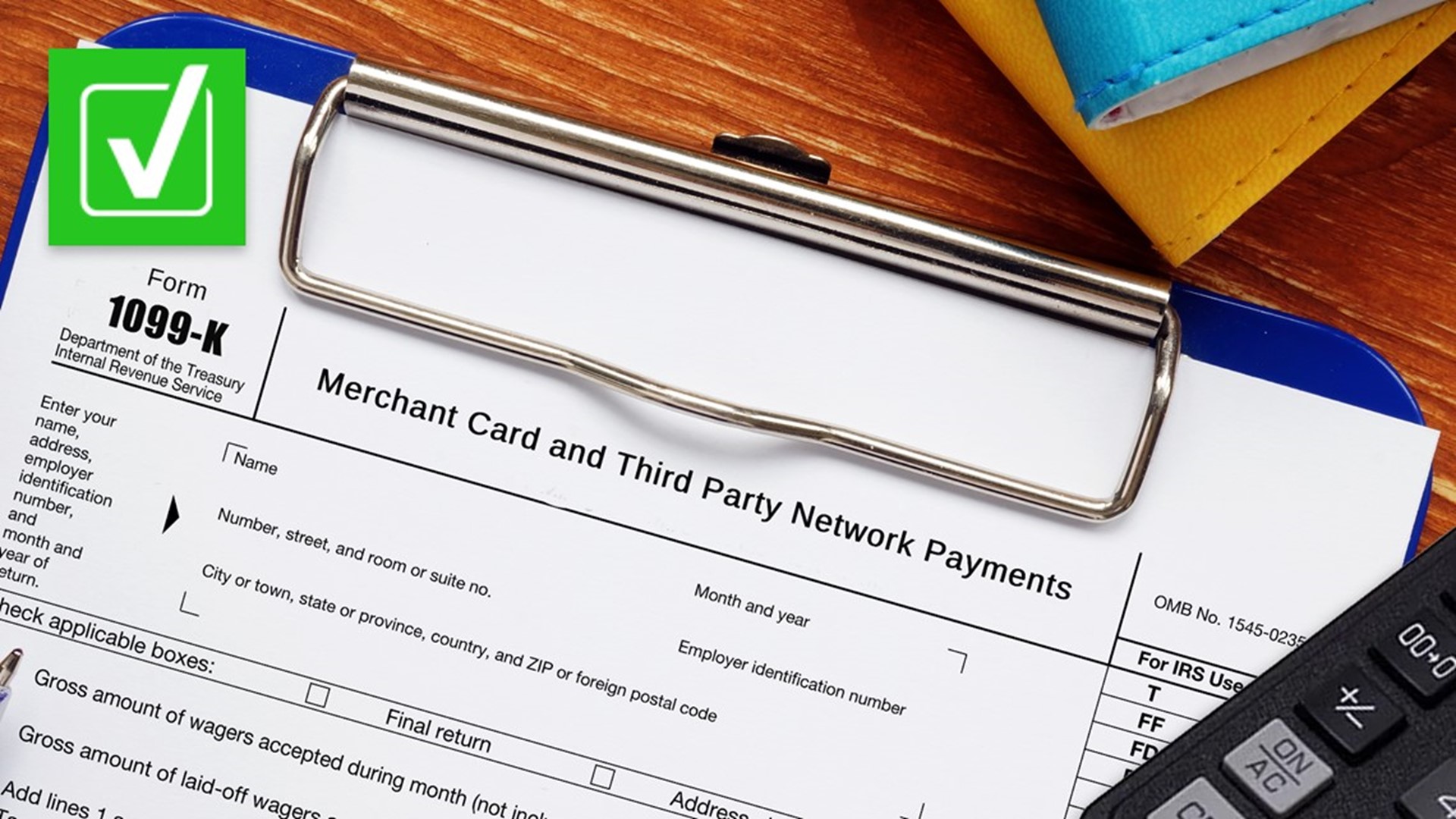

. Thats why Venmo is mandated to file and issue taxpayers with Form 1099-K Payment Card and Third. If you use PayPal Venmo or other P2P platforms. For the 2021 tax year Venmo will issue a Form 1099-K to business profile owners who have passed the IRS reporting threshold for their state of residence.

A series of posts on Facebook recently began circulating that suggested the Biden Administration was looking to tax payments made on internet platforms like Venmo PayPal. Venmo is a service of PayPal Inc a licensed provider of money transfer services NMLS ID. Individual states have their own rules for state income taxes in Maryland for instance.

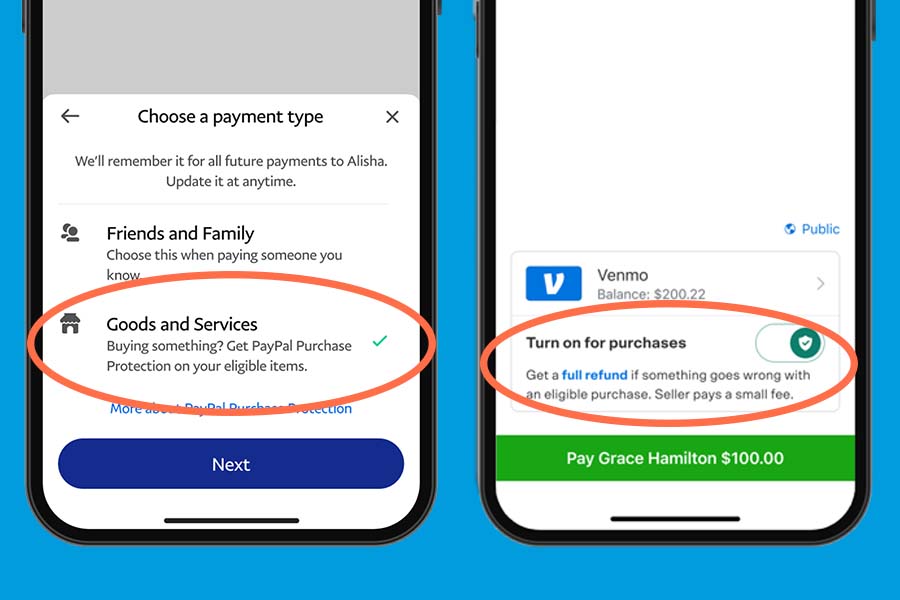

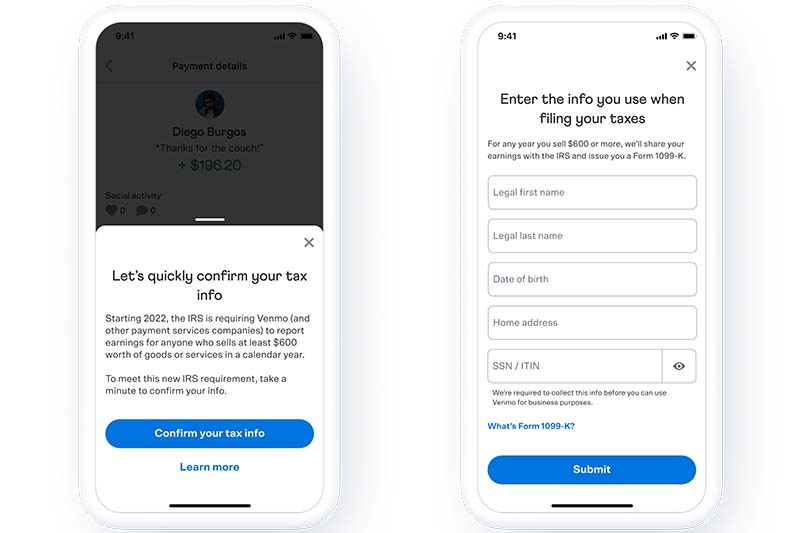

Due to lower federal IRS reporting thresholds for 2022 you may need to provide Venmo with your tax information if youre receiving payments for sales of goods and. The move can certainly send panic shivers down the spine. All custody of and trading in cryptocurrency is performed for Venmo by its licensed service provider Paxos Trust Company.

Side hustlers beware. Robot artist Ai-Da reset while speaking to UK politicians. Businesses are still required to report any payments received through Venmo and PayPal as taxable income when filing taxes.

Will you get taxed on personal Venmo payments. Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report. Any income you make over 600 is now being reported to the Internal Revenue Service by payment apps including eBay Venmo and Airbnb.

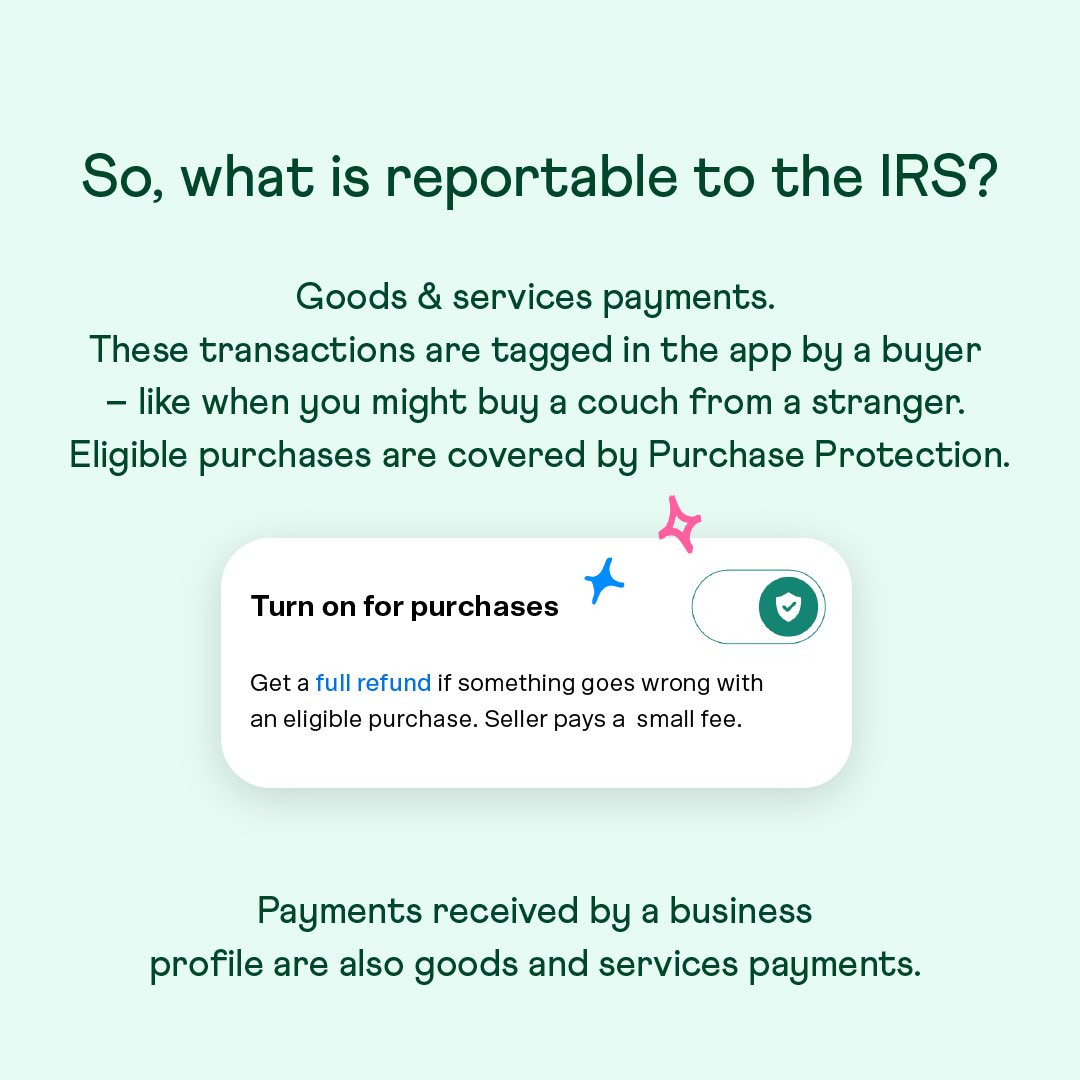

No your personal Venmo transactions wont get taxed even with the new law about 1099-K forms. The IRS is not requiring individuals to report or pay taxes on mobile payment app transactions over 600. The new law.

The IRS is not requiring individuals to report or pay taxes on. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the. If youre among the millions of people who use payment apps like PayPal Venmo Square and other third-party electronic payment networks you could be affected by a tax.

Consider seeking advice from your financial and tax advisor. Now in addition to freelancers and. The tax code change requires the platforms to report anyone who has more than 600 in commercial payments a.

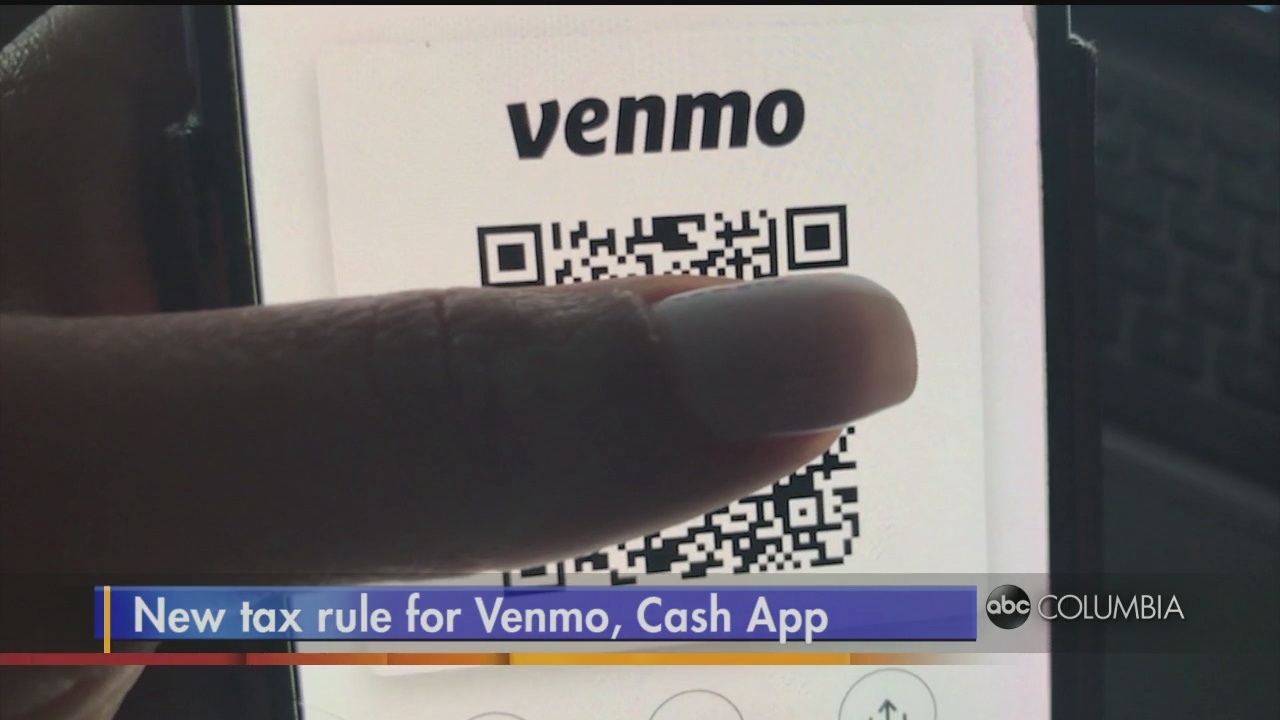

If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule. The transactions you received on Venmo may be taxable. For most states the threshold is.

What are tax holds. The new Venmo income reporting rules apply to an aggregate of 600 or more in income on goods or services through the calendar year. 1 the IRS said if a person accrues more than 600 annually in commercial payments on an app like Venmo then Venmo must file and furnish a Form 1099.

The Taxman Cometh The Irs Wants In On Your Venmo

New Tax Law Venmo Cash App To Report Business Transactions Over 600 Wrvo Public Media

Will Users Pay Taxes On Venmo Cash App Transactions It Depends

1099 K Myths Venmo Paypal Payments The Turbotax Blog

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

Stop Sending Money On Venmo There Are Better Alternatives Wired

What Cash App Users Need To Know About New Tax Form Proposals Verifythis Com

New Tax Rule Ensure Your Venmo Transactions Aren T Accidentally Taxed Gobankingrates

Paypal Taxes 2022 How Big Are The Transactions This App And Venmo Report To The Irs Marca

Fact Or Fiction Could We Soon Owe Taxes On Venmo Payments

Do You Have To Pay Taxes On Venmo And Zelle Payments

Taxes What To Know About Irs Changes For Payment Apps Like Venmo Paypal

Use Cash App Venmo Paypal Payment Reporting Is Changing For 2022 Jrj Income Tax Service

New Tax Rule Regarding Business Transactions On Payment Apps Abc Columbia

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Diving Into The New Irs Regulations Regarding Payment Platforms

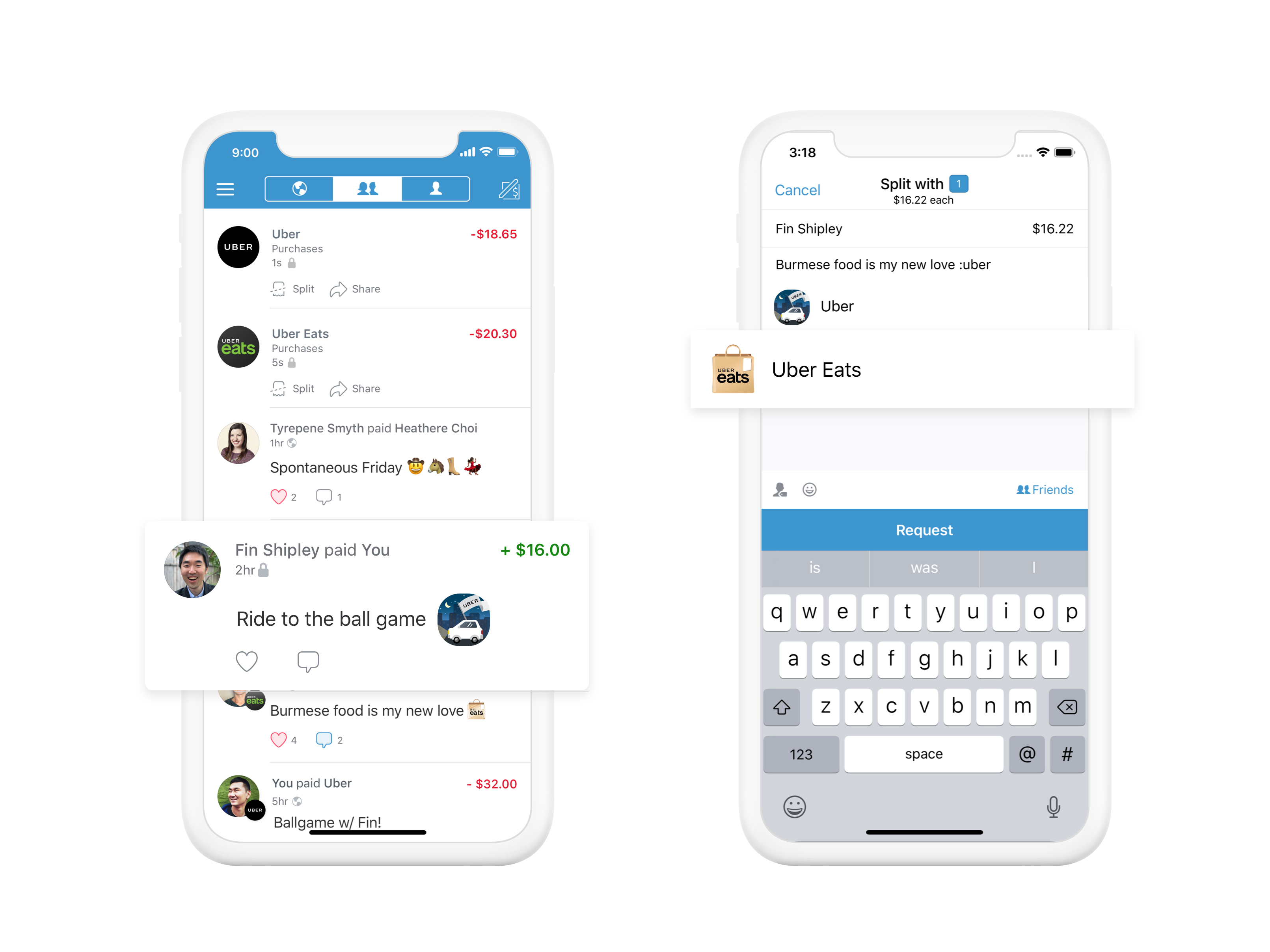

Uber And Venmo Partner To Deliver A New Payment Experience Business Wire

Venmo On Twitter Got Questions About Venmo Amp Taxes Let S Break Down Which Payments Are And Aren T Affected By The 2022 Tax Changes For More Info Head To Https T Co Pwh2p15gl2 Https T Co Behbpcnsxj Twitter